(11)Python引领金融前沿:投资组合优化实战案例

1. 前言

本篇文章为 Python 对金融的投资组合优化的示例。投资组合优化是从一组可用的投资组合中选择最佳投资组合的过程,目的是最大限度地提高回报和降低风险。

投资组合优化是从一组可用的投资组合中选择最佳投资组合的过程,目的是最大限度地提高回报和降低风险。

本案例研究涵盖了我们在前几课中介绍的许多 Python 编程基础知识,例如获取真实世界的市场财务数据、使用 pandas 执行数据分析以及使用 Matplotlib、Seaborn 和 Plotly Express 可视化投资组合数据。

2. 导入库和数据集

在本课中,您将学习如何导入库(例如用于数值分析的 NumPy),并学习如何导入和使用 datetime。此外,您还将学习如何导入数据以执行库提供的一些操作。

在开始之前,我们需要定义以下术语:

-

打开:股票市场开盘时证券首次交易的价格。

-

高:给定股票在常规交易时段内交易的最高价格。

-

低:给定股票在常规交易时段内交易的最低价格。

-

关闭:给定股票在常规交易时段交易的最后价格。

-

卷:开盘和收盘之间的交易股票数量。

-

调整关闭:考虑股票分割和股息后调整后的股票收盘价。

另请注意,纽约证券交易所 (NYSE) 于美国东部时间上午 9:30 开市,上海证券交易所 (SSE) 于中国标准时间上午 9:30 开市。

# Import key librares and modules

import pandas as pd

import numpy as np

# Import datetime module that comes pre-installed in Python

# datetime offers classes that work with date & time information

import datetime as dt

# Use Pandas to read stock data (the csv file is included in the course package)

stock_df = pd.read_csv('Amazon.csv')

stock_df.head(15)

# Count the number of missing values in "stock_df" Pandas DataFrame

stock_df.isnull().sum()

# Obtain information about the Pandas DataFrame such as data types, memory utilization..etc

stock_df.info()

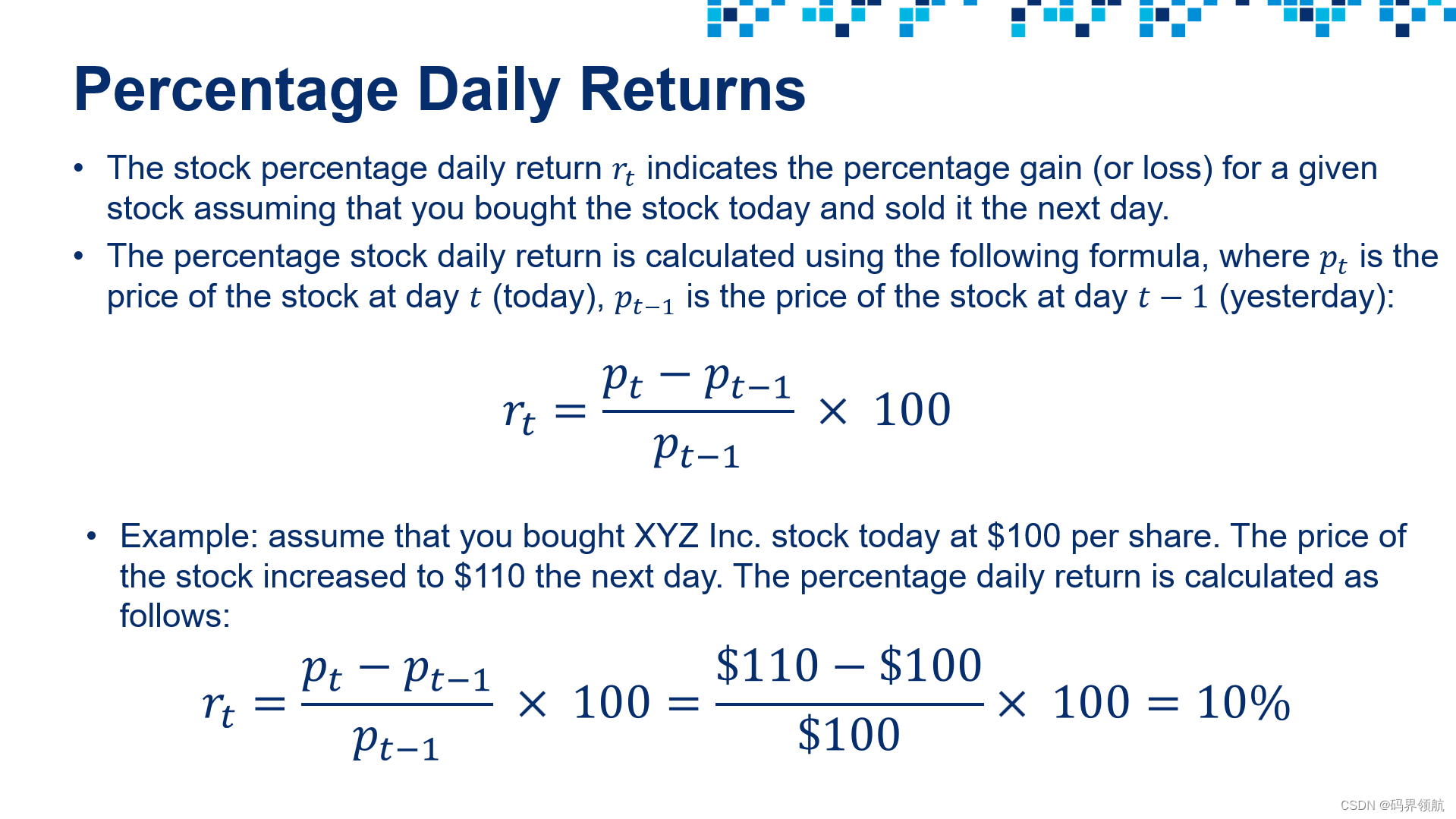

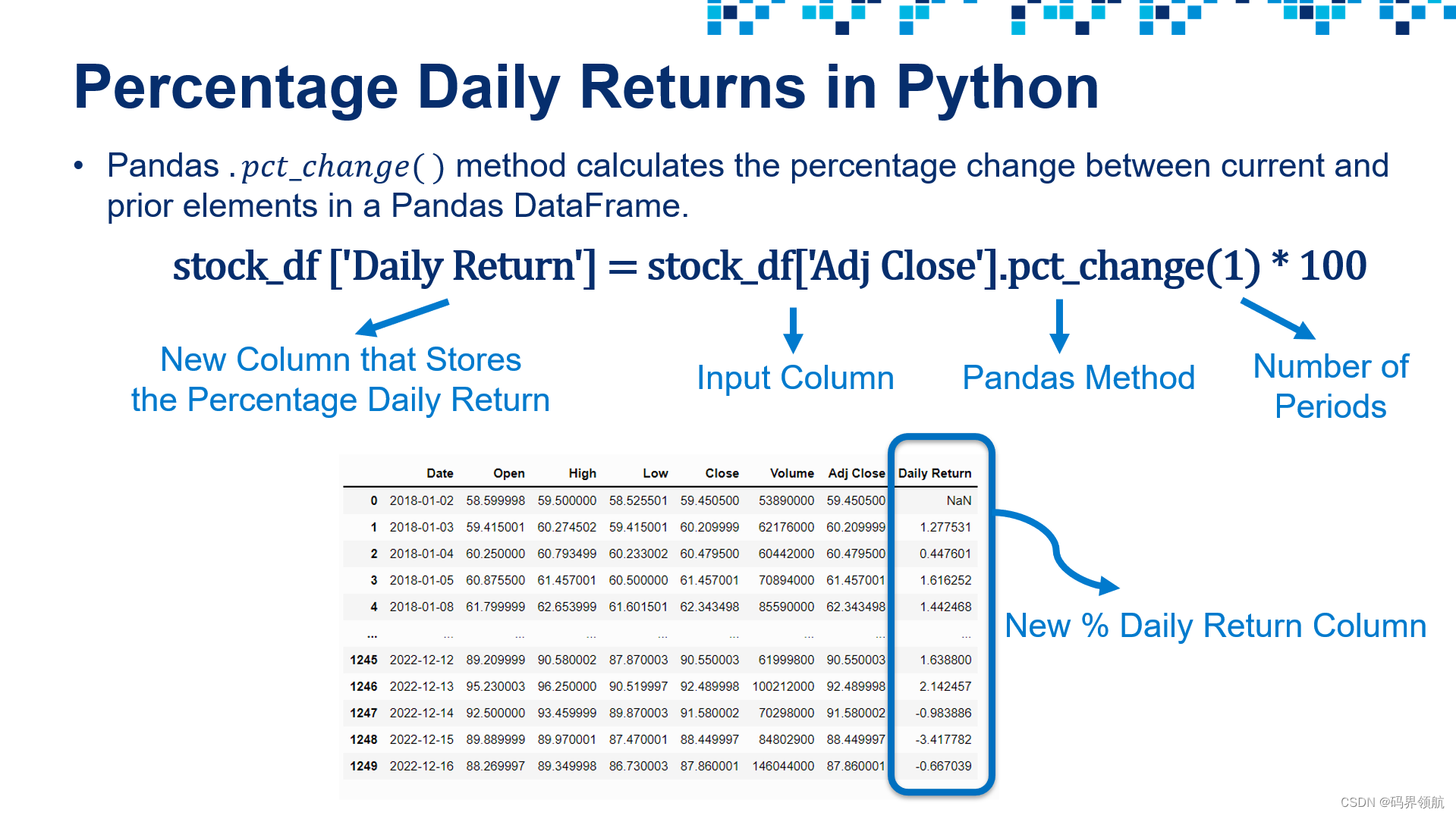

3. 计算每日回报率

# Calculate the percentage daily return

stock_df['Daily Return'] = stock_df['Adj Close'].pct_change(1) * 100

stock_df

输出:

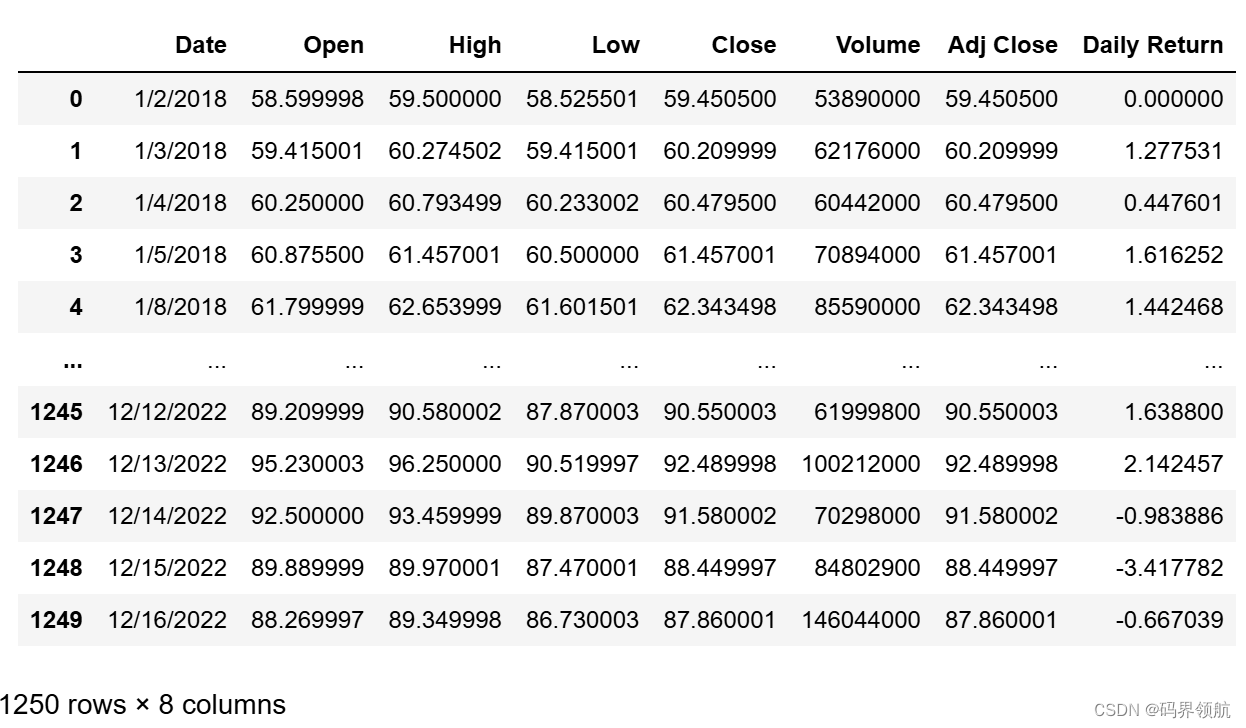

# Let's replace the first row with zeros instead of NaN

stock_df['Daily Return'].replace(np.nan, 0, inplace = True)

stock_df

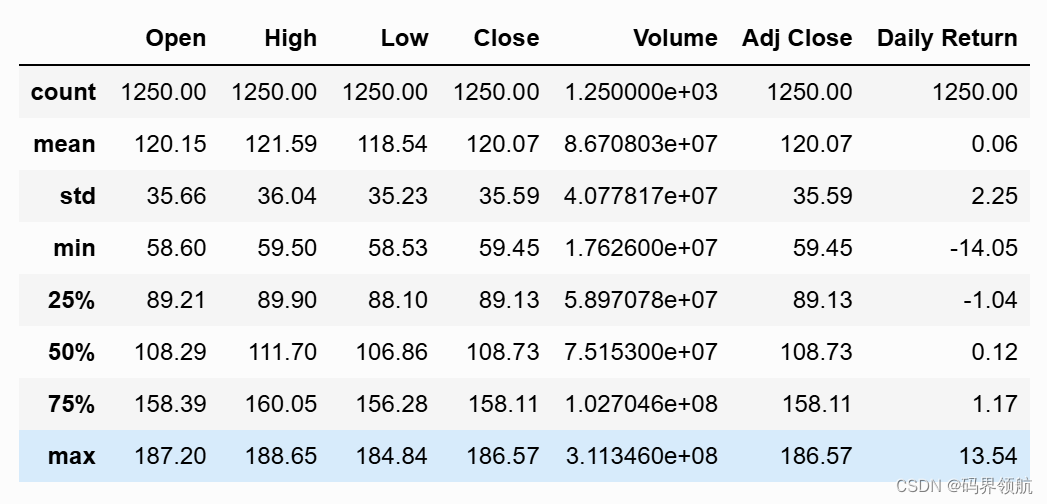

# Use the describe() method to obtain a statistical summary about the data

# Over the specified time period, the average adjusted close price for Amazon stock was $120.07

# The maximum adjusted close price was $186.57

# The maximum volume of shares traded on one day were 311,346,000

stock_df.describe().round(2)

4. 为单只股票进行数据可视化:第一部分

Matplotlib 官方文档: https://matplotlib.org/

Seaborn 官方文档: https://seaborn.pydata.org/

Plotly 官方文档: https://plotly.com/python/

# Matplotlib is a comprehensive data visualization library in Python

# Seaborn is a visualization library that sits on top of matplotlib and offers enhanced features

# plotly.express module contains functions that can create interactive figures using a few lines of code

import matplotlib.pyplot as plt

!pip install seaborn

import seaborn as sns

import plotly.express as px

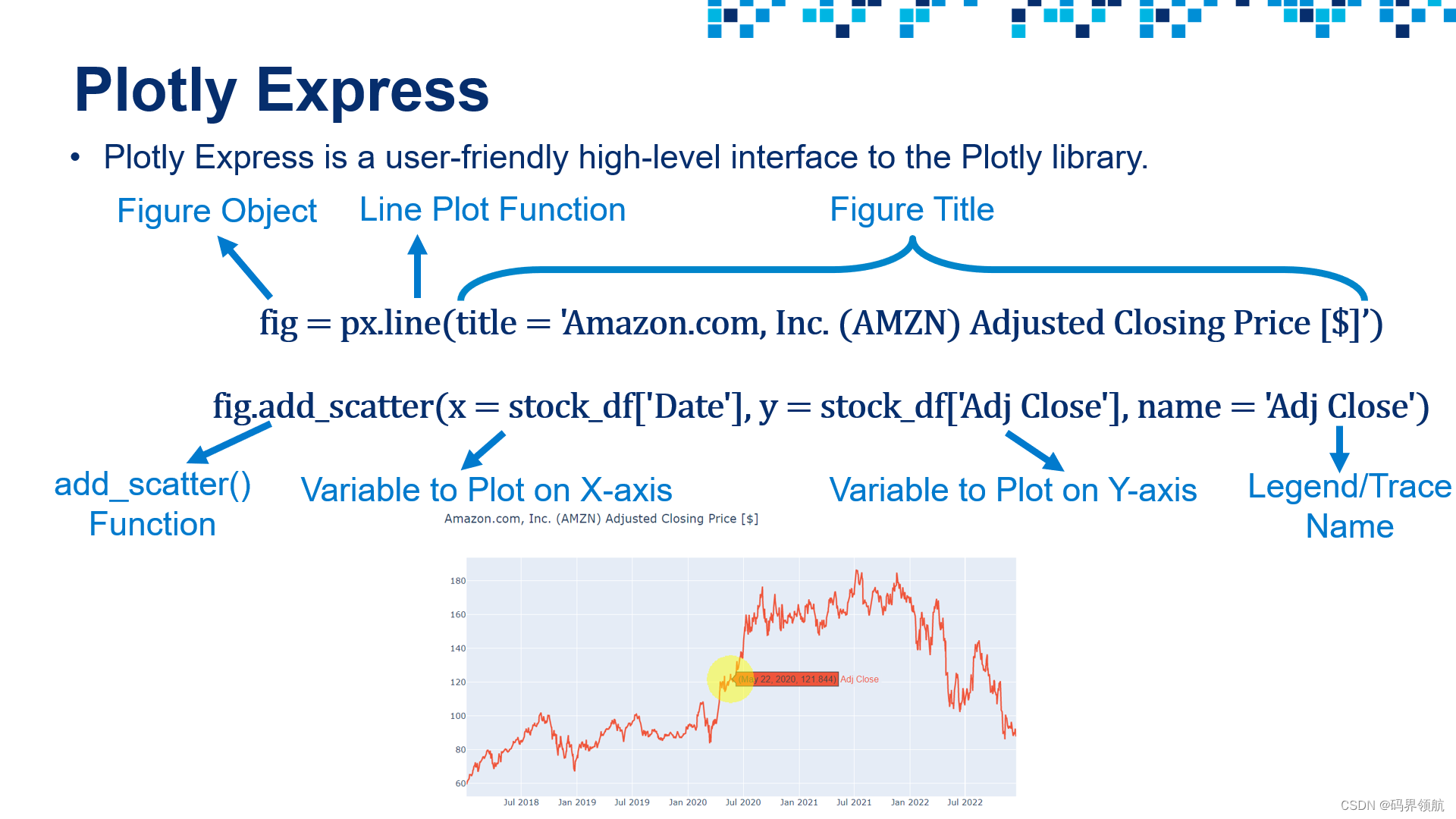

# Plot a Line Plot Using Plotly Express

fig = px.line(title = 'Amazon.com, Inc. (AMZN) Adjusted Closing Price [$]')

fig.add_scatter(x = stock_df['Date'], y = stock_df['Adj Close'], name = 'Adj Close')

stock_df

# Define a function that performs interactive data visualization using Plotly Express

def plot_financial_data(df, title):

fig = px.line(title = title)

# For loop that plots all stock prices in the pandas dataframe df

# Note that index starts with 1 because we want to skip the date column

for i in df.columns[1:]:

fig.add_scatter(x = df['Date'], y = df[i], name = i)

fig.update_traces(line_width = 5)

fig.update_layout({'plot_bgcolor': "white"})

fig.show()

# Plot High, Low, Open, Close and Adj Close

plot_financial_data(stock_df.drop(['Volume', 'Daily Return'], axis = 1), 'Amazon.com, Inc. (AMZN) Stock Price [$]')

# Plot trading volume

plot_financial_data(stock_df.iloc[:,[0,5]], 'Amazon.com, Inc. (AMZN) Trading Volume')

# Plot % Daily Returns

plot_financial_data(stock_df.iloc[:,[0,7]], 'Amazon.com, Inc. (AMZN) Percentage Daily Return [%]')

5. 为单只股票进行数据可视化:第二部分

# Define a function that classifies the returns based on the magnitude

# Feel free to change these numbers

def percentage_return_classifier(percentage_return):

if percentage_return > -0.3 and percentage_return <= 0.3:

return 'Insignificant Change'

elif percentage_return > 0.3 and percentage_return <= 3:

return 'Positive Change'

elif percentage_return > -3 and percentage_return <= -0.3:

return 'Negative Change'

elif percentage_return > 3 and percentage_return <= 7:

return 'Large Positive Change'

elif percentage_return > -7 and percentage_return <= -3:

return 'Large Negative Change'

elif percentage_return > 7:

return 'Bull Run'

elif percentage_return <= -7:

return 'Bear Sell Off'

# Apply the function to the "Daily Return" Column and place the result in "Trend" column

stock_df['Trend'] = stock_df['Daily Return'].apply(percentage_return_classifier)

stock_df

# Count distinct values in the Trend column

trend_summary = stock_df['Trend'].value_counts()

trend_summary

# Plot a pie chart using Matplotlib Library

plt.figure(figsize = (8, 8))

trend_summary.plot(kind = 'pie', y = 'Trend');

# Plot a pie chart using Matplotlib Library

plt.figure(figsize = (8, 8))

trend_summary.plot(kind = 'pie', y = 'Trend');

6. 为单只股票进行数据可视化:第三部分

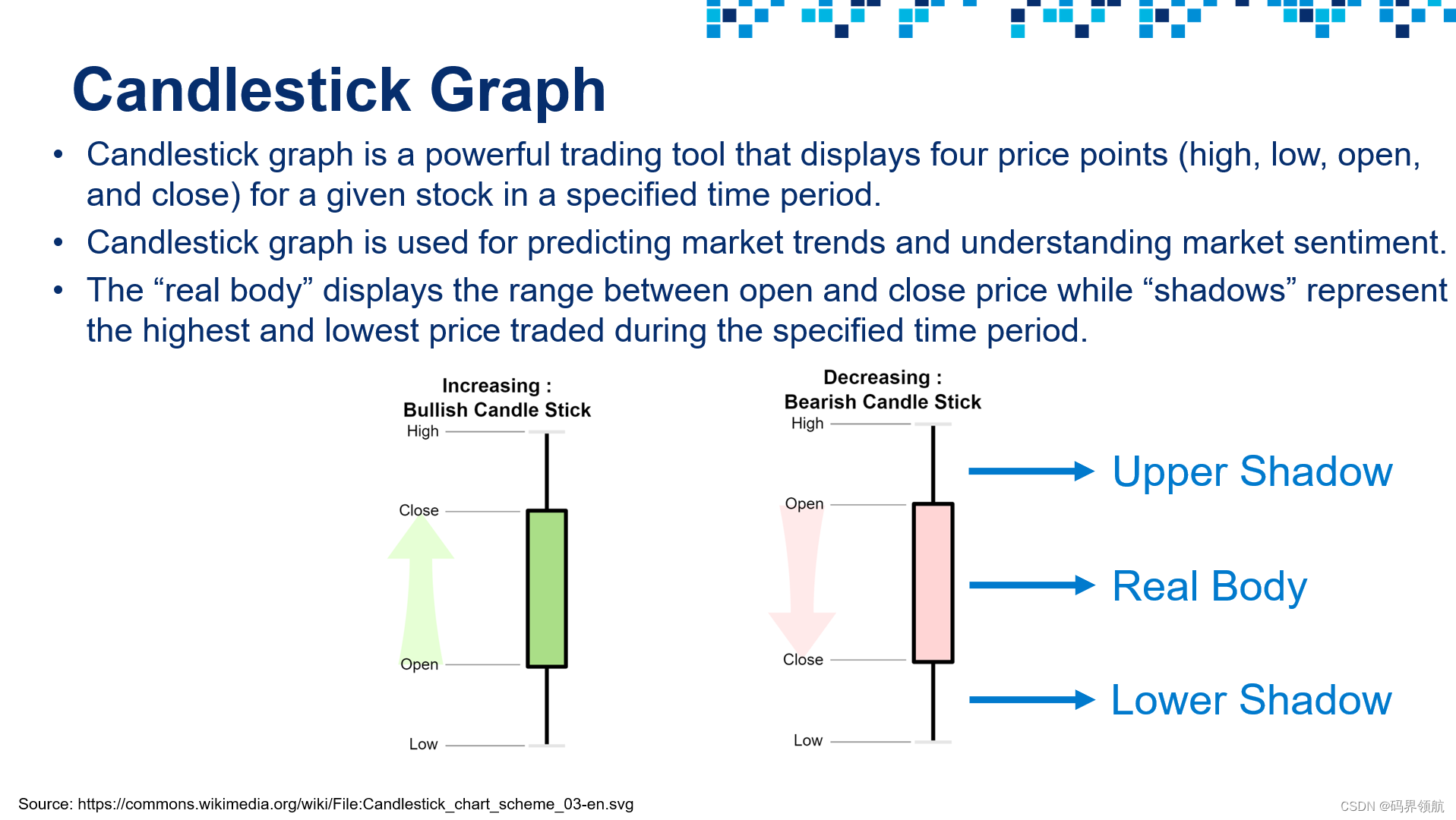

# Let's plot a candlestick graph using Cufflinks library

# Cufflinks is a powerful Python library that connects Pandas and Plotly for generating plots using few lines of code

# Cufflinks allows for interactive data visualization

! pip install cufflinks

import cufflinks as cf

cf.go_offline() # Enabling offline mode for interactive data visualization locally

stock_df

# Set the date to be the index for the Pandas DataFrame

# This is critical to show the date on the x-axis when using cufflinks

stock_df.set_index(['Date'], inplace = True)

stock_df

# Plot Candlestick figure using Cufflinks QuantFig module

figure = cf.QuantFig(stock_df, title = 'Amazon.com, Inc. (AMZN) Candlestick Chart', name = 'AMZN')

figure.add_sma(periods =[14, 21], column = 'Close', color = ['magenta', 'green'])

figure.iplot(theme = 'white', up_color = 'green', down_color = 'red')

7. 为多只股票进行数据可视化

# Let's read multiple stocks data contained in "stock_prices.csv" attached in the course package

# The Appendix includes details on how to obtain this data using yfinance and Pandas Datareader

# Note that yfinance and Pandas Datareader might experience outage in some geographical regions

# We will focus our analysis on U.S. stocks, similar analysis could be performed on Asian, European or African stocks

# AMZN: Amazon Inc. - Multinational tech company focusing on e-commerce, cloud computing, and artificial intelligence

# JPM: JPMorgan Chase and Co. - Multinational investment bank and financial services holding company

# META: Meta Platforms, formerly named Facebook Inc. - META owns Facebook, Instagram, and WhatsApp

# PG: Procter and Gamble (P&G) - Multinational consumer goods corporation

# GOOG: Google (Alphabet Inc.) - Multinational company that focuses on search engine tech, e-commerce, Cloud and AI

# CAT: Caterpillar - World's largest construction-equipment manufacturer

# PFE: Pfizer Inc. - Multinational pharmaceutical and biotechnology corporation

# EXC: Exelon - An American Fortune 100 energy company

# DE: Deere & Company (John Deere) - Manufactures agricultural machinery and heavy equipment

# JNJ: Johnson & Johnson - A multinational corporation that develops medical devices and pharmaceuticals

close_price_df = pd.read_csv('stock_prices.csv')

close_price_df

# The objective of this code cell is to calculate the percentage daily return

# We will perform this calculation on all stocks except for the first column which is "Date"

daily_returns_df = close_price_df.iloc[:, 1:].pct_change() * 100

daily_returns_df.replace(np.nan, 0, inplace = True)

daily_returns_df

# Insert the date column at the start of the Pandas DataFrame (@ index = 0)

daily_returns_df.insert(0, "Date", close_price_df['Date'])

daily_returns_df

# Plot closing prices using plotly Express. Note that we used the same pre-defined function "plot_financial_data"

plot_financial_data(close_price_df, 'Adjusted Closing Prices [$]')

# Plot the stocks daily returns

plot_financial_data(daily_returns_df, 'Percentage Daily Returns [%]')

# Plot histograms for stocks daily returns using plotly express

# Compare META to JNJ daily returns histograms

fig = px.histogram(daily_returns_df.drop(columns = ['Date']))

fig.update_layout({'plot_bgcolor': "white"})

# Plot a heatmap showing the correlations between daily returns

# Strong positive correlations between Catterpillar and John Deere - both into heavy equipment and machinery

# META and Google - both into Tech and Cloud Computing

plt.figure(figsize = (10, 8))

sns.heatmap(daily_returns_df.drop(columns = ['Date']).corr(), annot = True);

# Plot the Pairplot between stocks daily returns

sns.pairplot(daily_returns_df);

# Function to scale stock prices based on their initial starting price

# The objective of this function is to set all prices to start at a value of 1

def price_scaling(raw_prices_df):

scaled_prices_df = raw_prices_df.copy()

for i in raw_prices_df.columns[1:]:

scaled_prices_df[i] = raw_prices_df[i]/raw_prices_df[i][0]

return scaled_prices_df

price_scaling(close_price_df)

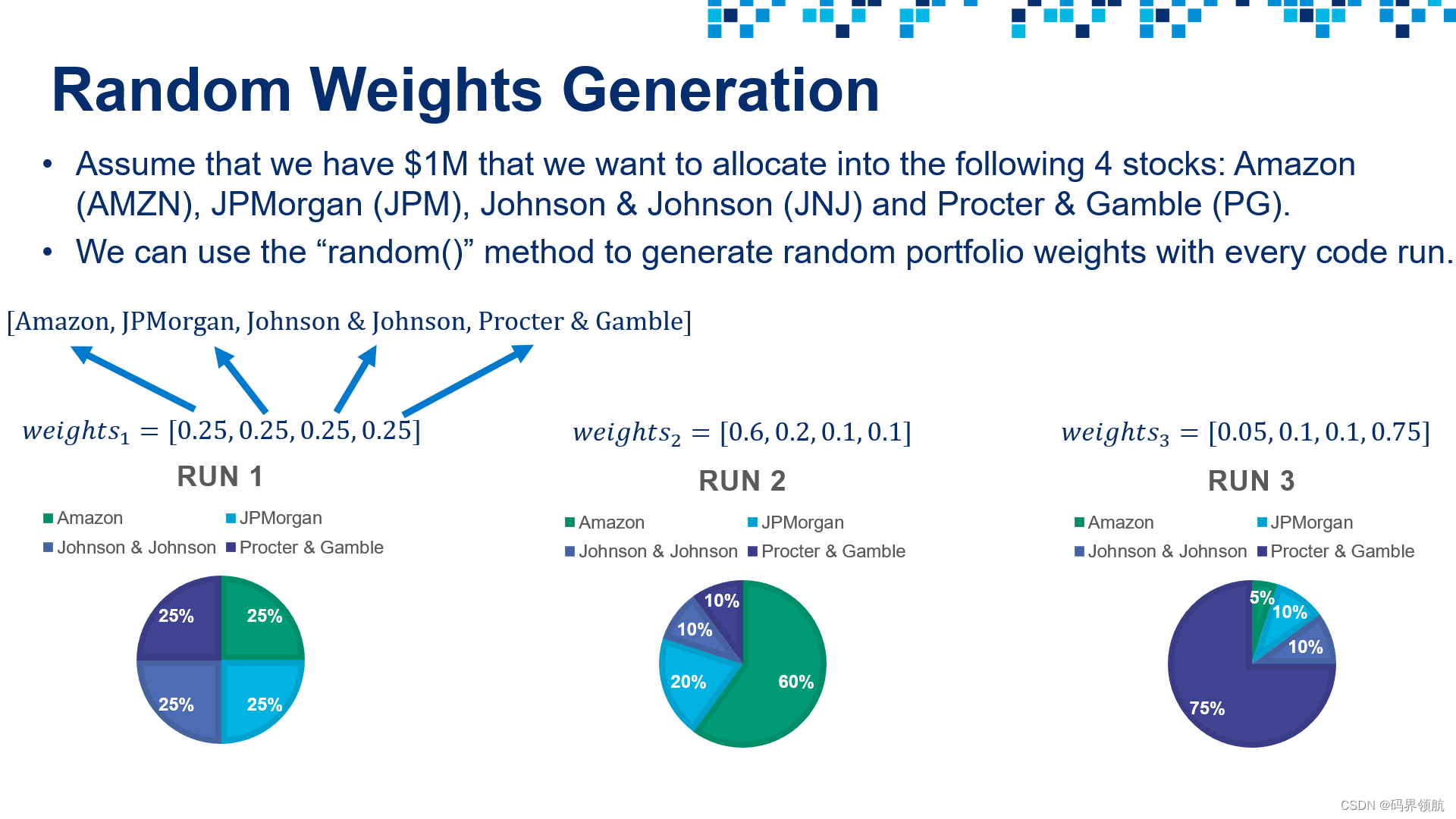

8. 定义一个生成随机投资组合权重的函数

# Let's create an array that holds random portfolio weights

# Note that portfolio weights must add up to 1

import random

def generate_portfolio_weights(n):

weights = []

for i in range(n):

weights.append(random.random())

# let's make the sum of all weights add up to 1

weights = weights/np.sum(weights)

return weights

# Call the function (Run this cell multiple times to generate different outputs)

weights = generate_portfolio_weights(4)

print(weights)

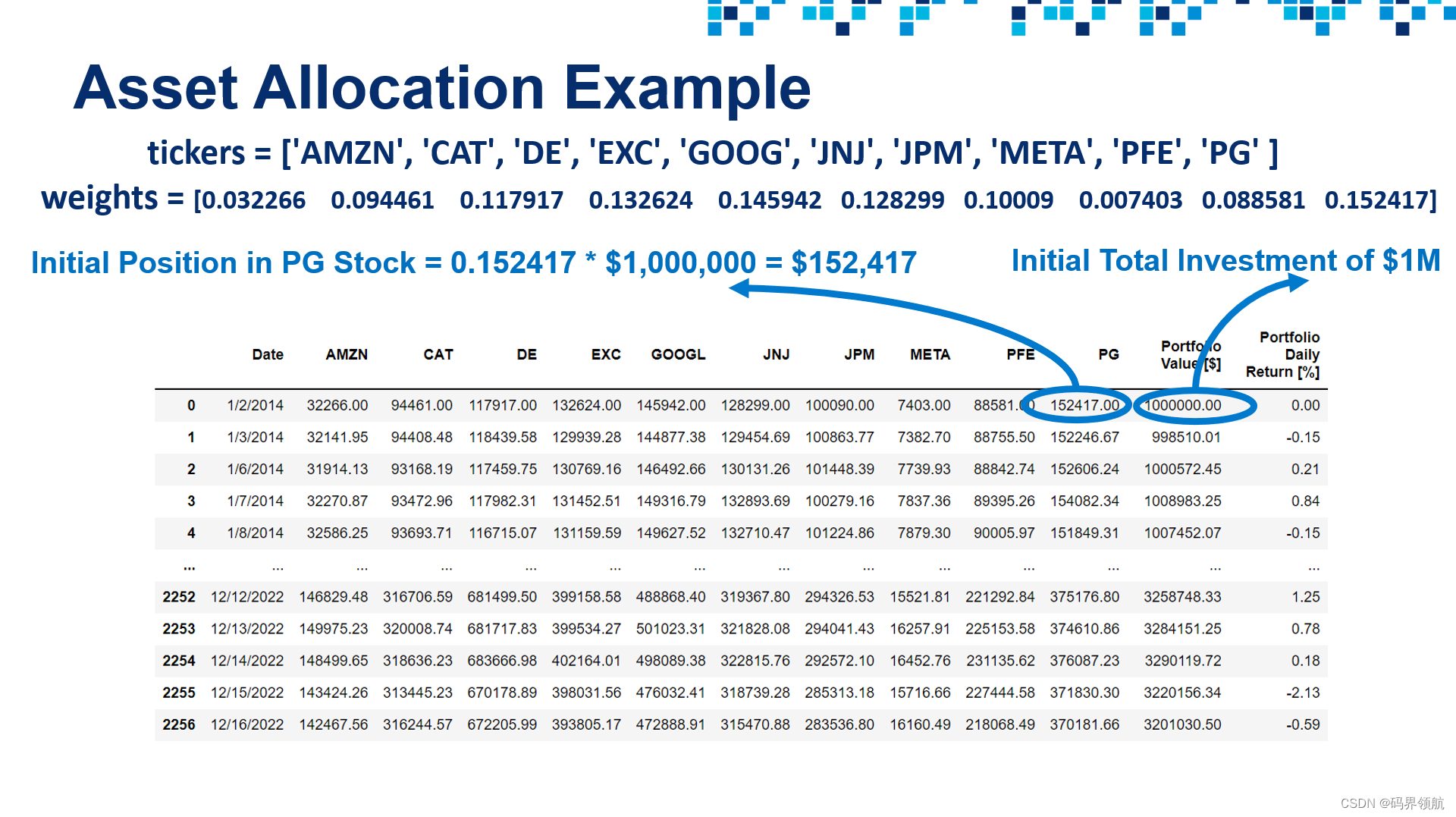

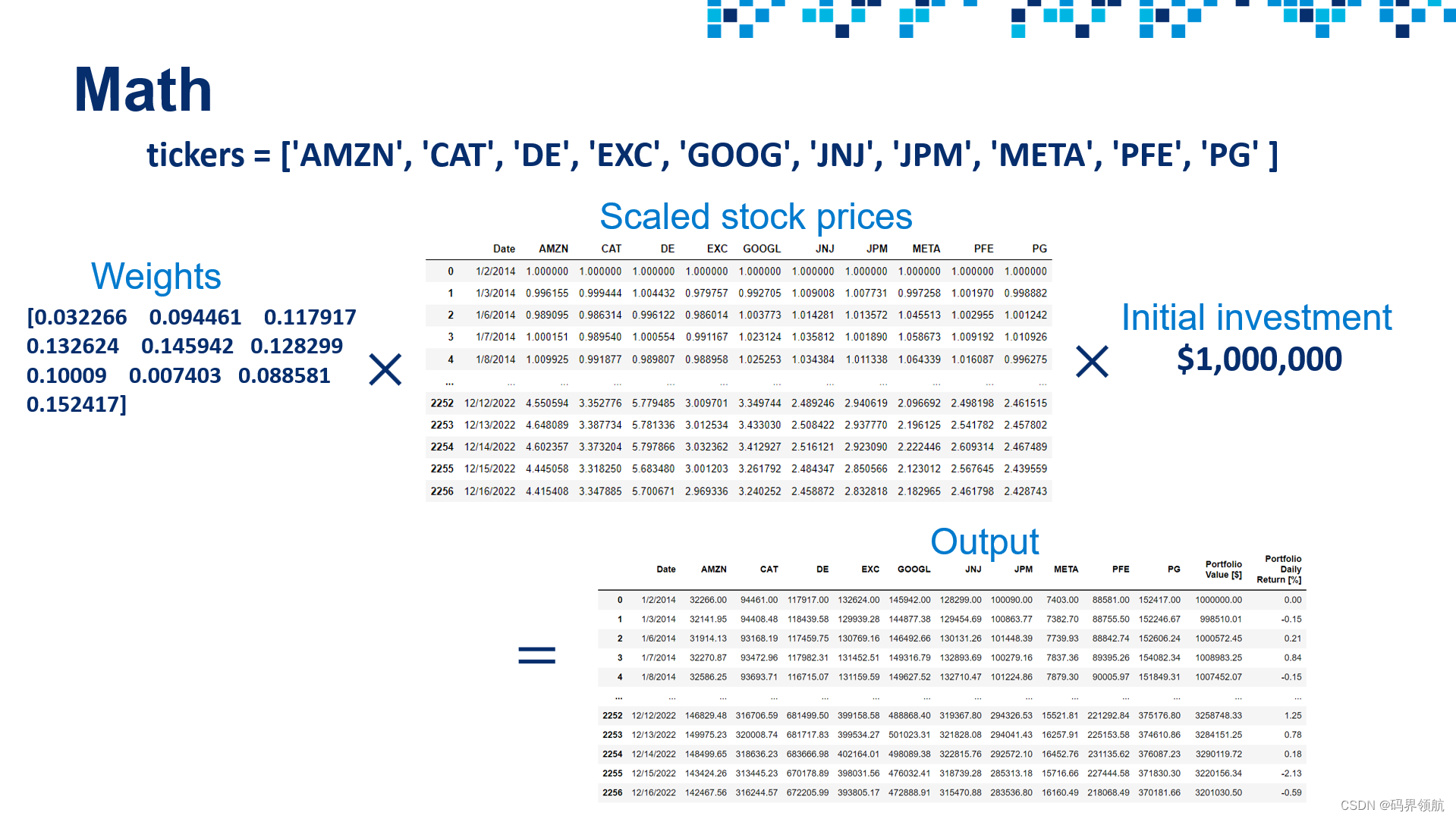

9. 进行资产配置并计算投资组合的日价值/回报率

# Let's define the "weights" list similar to the slides

weights = [0.032266, 0.094461, 0.117917, 0.132624, 0.145942, 0.128299, 0.10009, 0.007403, 0.088581, 0.152417]

weights

# Let's display "close_price_df" Pandas DataFrame

close_price_df

# Scale stock prices using the "price_scaling" function that we defined earlier (make all stock values start at 1)

portfolio_df = close_price_df.copy()

scaled_df = price_scaling(portfolio_df)

scaled_df

# Use enumerate() method to obtain the stock names along with a counter "i" (0, 1, 2, 3,..etc.)

# This counter "i" will be used as an index to access elements in the "weights" list

initial_investment = 1000000

for i, stock in enumerate(scaled_df.columns[1:]):

portfolio_df[stock] = weights[i] * scaled_df[stock] * initial_investment

portfolio_df.round(1)

# Assume that we have $1,000,000 that we would like to invest in one or more of the selected stocks

# Let's create a function that receives the following arguments:

# (1) Stocks closing prices

# (2) Random weights

# (3) Initial investment amount

# The function will return a DataFrame that contains the following:

# (1) Daily value (position) of each individual stock over the specified time period

# (2) Total daily value of the portfolio

# (3) Percentage daily return

def asset_allocation(df, weights, initial_investment):

portfolio_df = df.copy()

# Scale stock prices using the "price_scaling" function that we defined earlier (Make them all start at 1)

scaled_df = price_scaling(df)

for i, stock in enumerate(scaled_df.columns[1:]):

portfolio_df[stock] = scaled_df[stock] * weights[i] * initial_investment

# Sum up all values and place the result in a new column titled "portfolio value [$]"

# Note that we excluded the date column from this calculation

portfolio_df['Portfolio Value [$]'] = portfolio_df[portfolio_df != 'Date'].sum(axis = 1, numeric_only = True)

# Calculate the portfolio percentage daily return and replace NaNs with zeros

portfolio_df['Portfolio Daily Return [%]'] = portfolio_df['Portfolio Value [$]'].pct_change(1) * 100

portfolio_df.replace(np.nan, 0, inplace = True)

return portfolio_df

# Now let's put this code in a function and generate random weights

# Let's obtain the number of stocks under consideration (note that we ignored the "Date" column)

n = len(close_price_df.columns)-1

# Let's generate random weights

print('Number of stocks under consideration = {}'.format(n))

weights = generate_portfolio_weights(n).round(6)

print('Portfolio weights = {}'.format(weights))

# Let's test out the "asset_allocation" function

portfolio_df = asset_allocation(close_price_df, weights, 1000000)

portfolio_df.round(2)

# Plot the portfolio percentage daily return

plot_financial_data(portfolio_df[['Date', 'Portfolio Daily Return [%]']], 'Portfolio Percentage Daily Return [%]')

# Plot each stock position in our portfolio over time

# This graph shows how our initial investment in each individual stock grows over time

plot_financial_data(portfolio_df.drop(['Portfolio Value [$]', 'Portfolio Daily Return [%]'], axis = 1), 'Portfolio positions [$]')

# Plot the total daily value of the portfolio (sum of all positions)

plot_financial_data(portfolio_df[['Date', 'Portfolio Value [$]']], 'Total Portfolio Value [$]')

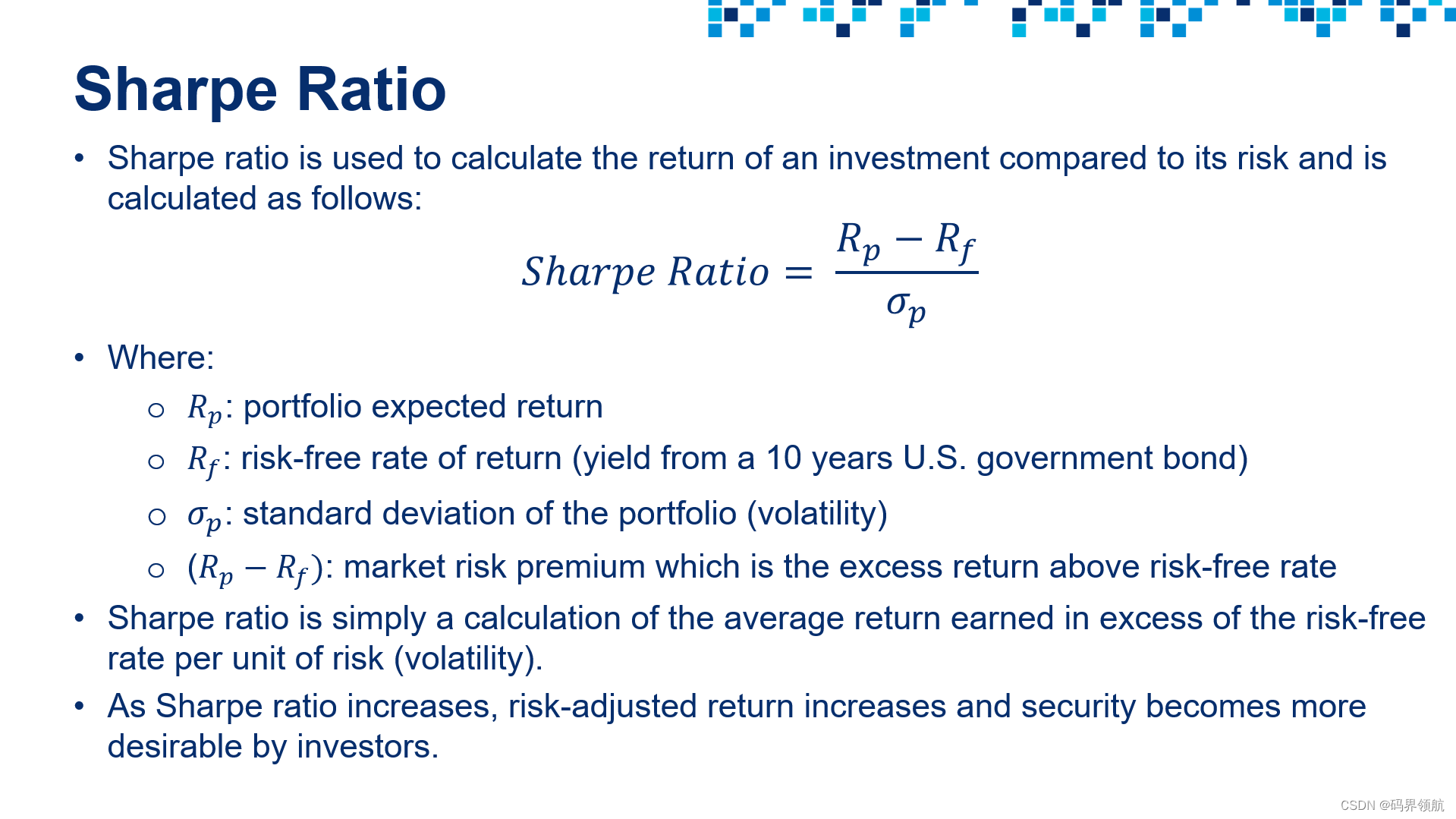

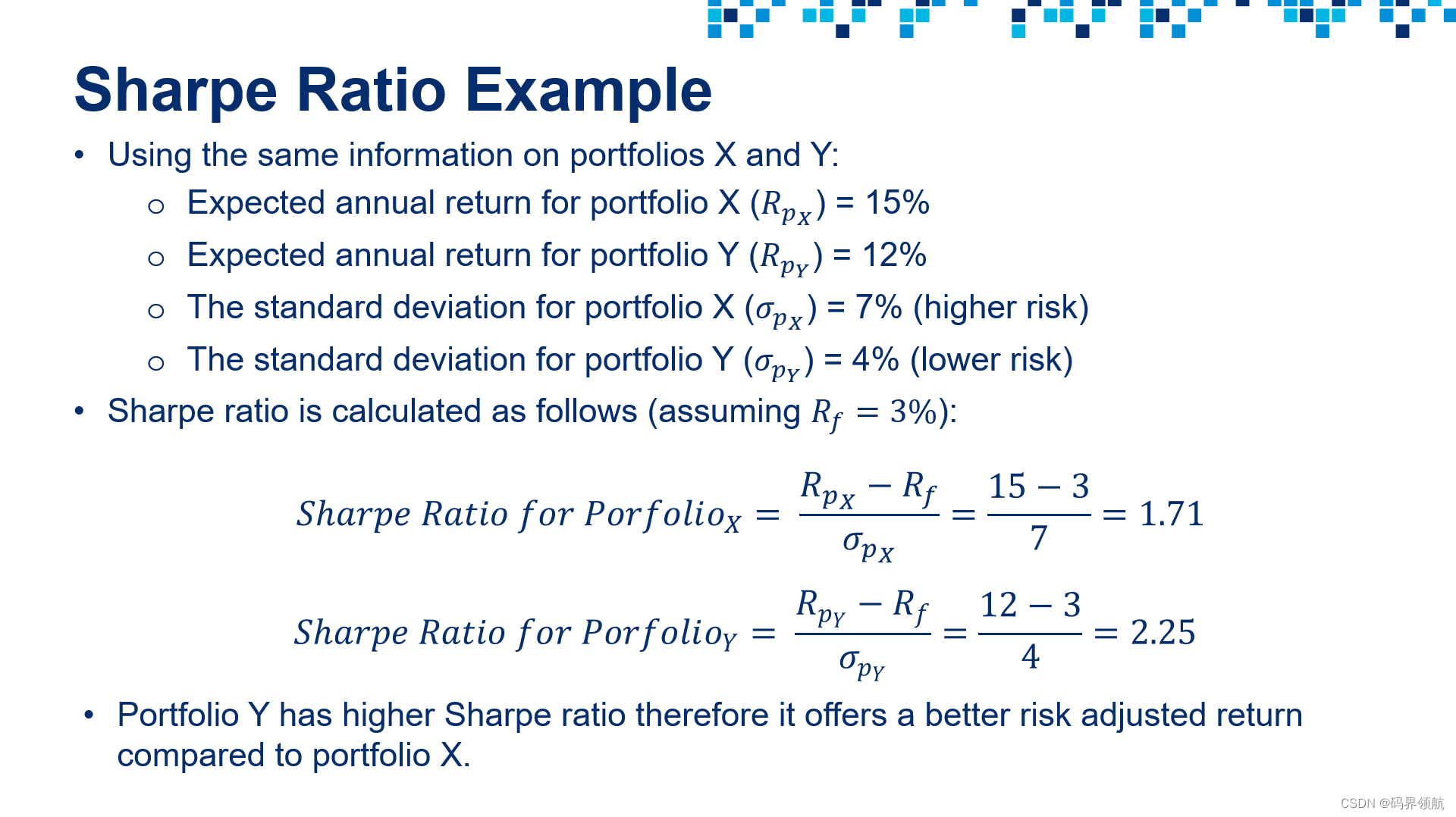

10. 定义“模拟”函数,该函数执行资产配置并计算关键的投资组合指标

# Let's define the simulation engine function

# The function receives:

# (1) portfolio weights

# (2) initial investment amount

# The function performs asset allocation and calculates portfolio statistical metrics including Sharpe ratio

# The function returns:

# (1) Expected portfolio return

# (2) Expected volatility

# (3) Sharpe ratio

# (4) Return on investment

# (5) Final portfolio value in dollars

def simulation_engine(weights, initial_investment):

# Perform asset allocation using the random weights (sent as arguments to the function)

portfolio_df = asset_allocation(close_price_df, weights, initial_investment)

# Calculate the return on the investment

# Return on investment is calculated using the last final value of the portfolio compared to its initial value

return_on_investment = ((portfolio_df['Portfolio Value [$]'][-1:] -

portfolio_df['Portfolio Value [$]'][0])/

portfolio_df['Portfolio Value [$]'][0]) * 100

# Daily change of every stock in the portfolio (Note that we dropped the date, portfolio daily worth and daily % returns)

portfolio_daily_return_df = portfolio_df.drop(columns = ['Date', 'Portfolio Value [$]', 'Portfolio Daily Return [%]'])

portfolio_daily_return_df = portfolio_daily_return_df.pct_change(1)

# Portfolio Expected Return formula

expected_portfolio_return = np.sum(weights * portfolio_daily_return_df.mean() ) * 252

# Portfolio volatility (risk) formula

# The risk of an asset is measured using the standard deviation which indicates the dispertion away from the mean

# The risk of a portfolio is not a simple sum of the risks of the individual assets within the portfolio

# Portfolio risk must consider correlations between assets within the portfolio which is indicated by the covariance

# The covariance determines the relationship between the movements of two random variables

# When two stocks move together, they have a positive covariance when they move inversely, the have a negative covariance

covariance = portfolio_daily_return_df.cov() * 252

expected_volatility = np.sqrt(np.dot(weights.T, np.dot(covariance, weights)))

# Check out the chart for the 10-years U.S. treasury at https://ycharts.com/indicators/10_year_treasury_rate

rf = 0.03 # Try to set the risk free rate of return to 1% (assumption)

# Calculate Sharpe ratio

sharpe_ratio = (expected_portfolio_return - rf)/expected_volatility

return expected_portfolio_return, expected_volatility, sharpe_ratio, portfolio_df['Portfolio Value [$]'][-1:].values[0], return_on_investment.values[0]

# Let's test out the "simulation_engine" function and print out statistical metrics

# Define the initial investment amount

initial_investment = 1000000

portfolio_metrics = simulation_engine(weights, initial_investment)

print('Expected Portfolio Annual Return = {:.2f}%'.format(portfolio_metrics[0] * 100))

print('Portfolio Standard Deviation (Volatility) = {:.2f}%'.format(portfolio_metrics[1] * 100))

print('Sharpe Ratio = {:.2f}'.format(portfolio_metrics[2]))

print('Portfolio Final Value = ${:.2f}'.format(portfolio_metrics[3]))

print('Return on Investment = {:.2f}%'.format(portfolio_metrics[4]))

11. 运行蒙特卡罗模拟

# Set the number of simulation runs

sim_runs = 10000

initial_investment = 1000000

# Placeholder to store all weights

weights_runs = np.zeros((sim_runs, n))

# Placeholder to store all Sharpe ratios

sharpe_ratio_runs = np.zeros(sim_runs)

# Placeholder to store all expected returns

expected_portfolio_returns_runs = np.zeros(sim_runs)

# Placeholder to store all volatility values

volatility_runs = np.zeros(sim_runs)

# Placeholder to store all returns on investment

return_on_investment_runs = np.zeros(sim_runs)

# Placeholder to store all final portfolio values

final_value_runs = np.zeros(sim_runs)

for i in range(sim_runs):

# Generate random weights

weights = generate_portfolio_weights(n)

# Store the weights

weights_runs[i,:] = weights

# Call "simulation_engine" function and store Sharpe ratio, return and volatility

# Note that asset allocation is performed using the "asset_allocation" function

expected_portfolio_returns_runs[i], volatility_runs[i], sharpe_ratio_runs[i], final_value_runs[i], return_on_investment_runs[i] = simulation_engine(weights, initial_investment)

print("Simulation Run = {}".format(i))

print("Weights = {}, Final Value = ${:.2f}, Sharpe Ratio = {:.2f}".format(weights_runs[i].round(3), final_value_runs[i], sharpe_ratio_runs[i]))

print('\n')

12. 执行投资组合优化

# List all Sharpe ratios generated from the simulation

sharpe_ratio_runs

# Return the index of the maximum Sharpe ratio (Best simulation run)

sharpe_ratio_runs.argmax()

# Return the maximum Sharpe ratio value

sharpe_ratio_runs.max()

weights_runs

# Obtain the portfolio weights that correspond to the maximum Sharpe ratio (Golden set of weights!)

weights_runs[sharpe_ratio_runs.argmax(), :]

# Return Sharpe ratio, volatility corresponding to the best weights allocation (maximum Sharpe ratio)

optimal_portfolio_return, optimal_volatility, optimal_sharpe_ratio, highest_final_value, optimal_return_on_investment = simulation_engine(weights_runs[sharpe_ratio_runs.argmax(), :], initial_investment)

print('Best Portfolio Metrics Based on {} Monte Carlo Simulation Runs:'.format(sim_runs))

print(' - Portfolio Expected Annual Return = {:.02f}%'.format(optimal_portfolio_return * 100))

print(' - Portfolio Standard Deviation (Volatility) = {:.02f}%'.format(optimal_volatility * 100))

print(' - Sharpe Ratio = {:.02f}'.format(optimal_sharpe_ratio))

print(' - Final Value = ${:.02f}'.format(highest_final_value))

print(' - Return on Investment = {:.02f}%'.format(optimal_return_on_investment))

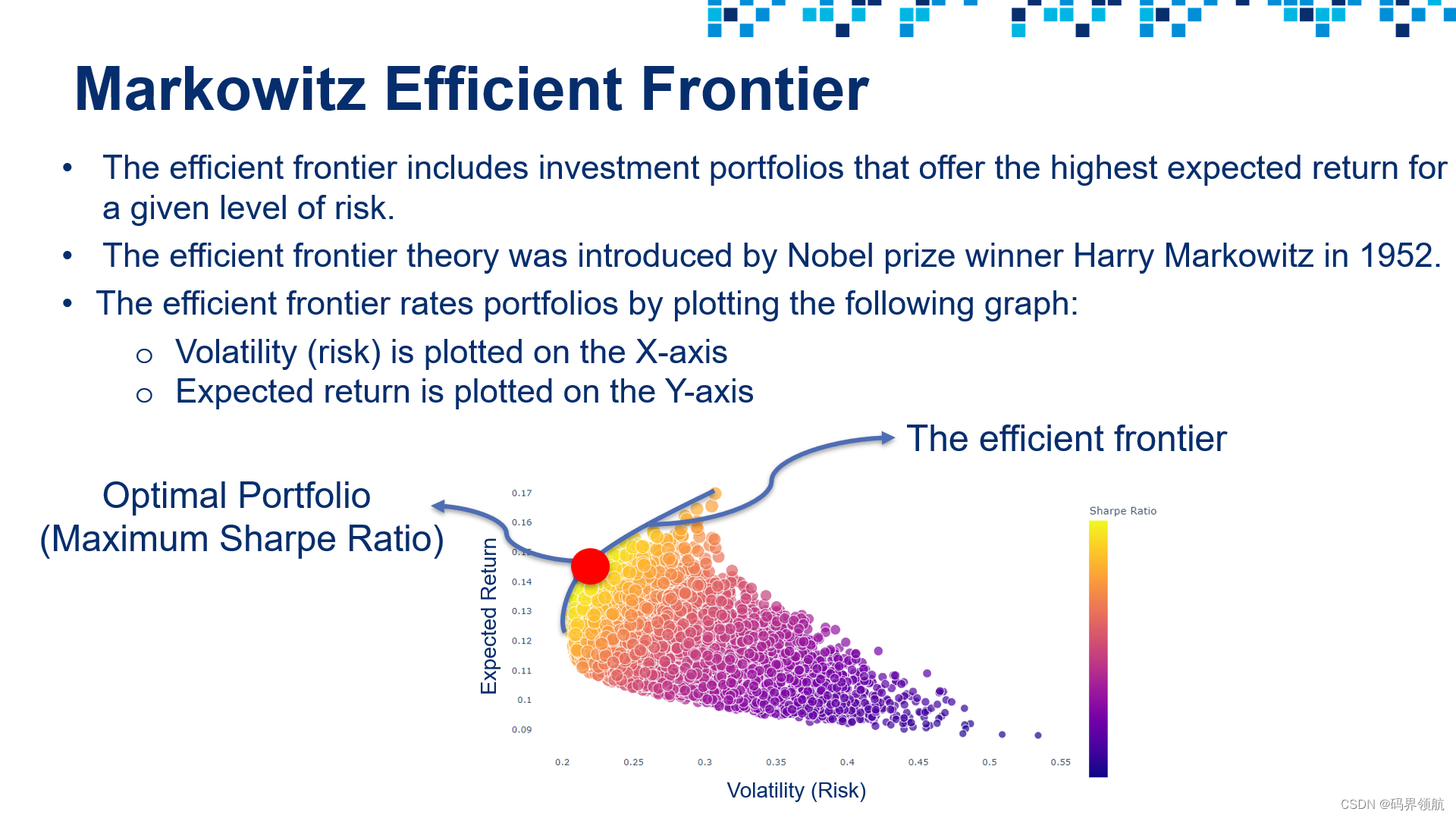

# Create a DataFrame that contains volatility, return, and Sharpe ratio for all simualation runs

sim_out_df = pd.DataFrame({'Volatility': volatility_runs.tolist(), 'Portfolio_Return': expected_portfolio_returns_runs.tolist(), 'Sharpe_Ratio': sharpe_ratio_runs.tolist() })

sim_out_df

# Plot volatility vs. return for all simulation runs

# Highlight the volatility and return that corresponds to the highest Sharpe ratio

import plotly.graph_objects as go

fig = px.scatter(sim_out_df, x = 'Volatility', y = 'Portfolio_Return', color = 'Sharpe_Ratio', size = 'Sharpe_Ratio', hover_data = ['Sharpe_Ratio'] )

fig.update_layout({'plot_bgcolor': "white"})

fig.show()

# Use this code if Sharpe ratio is negative

# fig = px.scatter(sim_out_df, x = 'Volatility', y = 'Portfolio_Return', color = 'Sharpe_Ratio', hover_data = ['Sharpe_Ratio'] )

# Let's highlight the point with the highest Sharpe ratio

fig = px.scatter(sim_out_df, x = 'Volatility', y = 'Portfolio_Return', color = 'Sharpe_Ratio', size = 'Sharpe_Ratio', hover_data = ['Sharpe_Ratio'] )

fig.add_trace(go.Scatter(x = [optimal_volatility], y = [optimal_portfolio_return], mode = 'markers', name = 'Optimal Point', marker = dict(size=[40], color = 'red')))

fig.update_layout(coloraxis_colorbar = dict(y = 0.7, dtick = 5))

fig.update_layout({'plot_bgcolor': "white"})

fig.show()

原文地址:https://blog.csdn.net/huanzi833/article/details/140146078

免责声明:本站文章内容转载自网络资源,如本站内容侵犯了原著者的合法权益,可联系本站删除。更多内容请关注自学内容网(zxcms.com)!