SAP 多银行连接 MBC 您需要了解的一切

SAP Multi-Bank Connectivity (MBC) – All You Need to Know

Multi-Bank Connectivity Overview

SAP Multi-Bank Connectivity (MBC) is an SAP Business Technology Platform (BTP) solution managed by SAP to provide customers connectivity with their financial services institutions. The solution provides corporates with a multibank, digital channel between their ERP systems and their banks. MBC provides:

- Streamlined multiple bank/corporate on-boarding

- A secure channel of communication for payment processes

- Seamless end-to-end payment processes through core ERP integration

Supported Message Types

SAP Multi-Bank Connectivity supports the exchange of all types of messages. The most relevant sources of messages are automated, but other sources and message types can also be sent to the cloud service or can be received.

Fully Automated processing:

- Payments and Status Messages - ISO 20022 outbound payment formats PAIN.001, PAIN.002, SWIFT ACK/NACK, Delivery Reports)

- Bank statement processing - CAMT.052, CAMT.053, CAMT.054, MT940, MT942, BAI / BAI2)

- Bank Service Billing Messages - CAMT.086

- Treasury confirmations -MT300 & MT320

Manual processing

- Any Message Types

All of the above messages can be monitored with Fiori app “Manage Bank Messages” (App ID F4385)

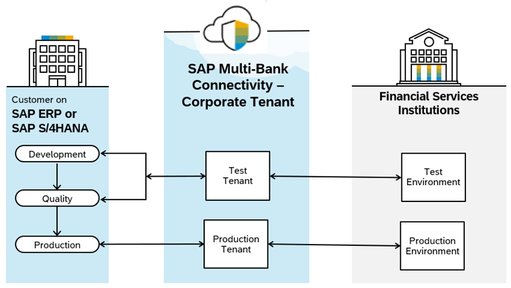

SAP MBC system landscape

SAP Multi-Bank Connectivity exposes two system landscapes: test and production. Please note that generally we have 3-tier system landscape for SAP S/4HANA and therefore we need to switch the connectivity from SAP S/4HANA Dev system to SAP S/4HANA quality system to connect to MBC test tenant. SAP S/4HANA Production system will be connected to MBC production tenant.

Security

To set up a secure connection between a customer system and SAP Multi-Bank Connectivity, several artifacts must be exchanged, such as public keys for Transport Layer Security (TLS) and Message Layer Security (MLS) encryption/decryption. In addition, it may be necessary to allowlist SAP IP ranges depending on your firewall position.

Message Level Security is optional for bank connections but highly recommended by SAP for the secure transfer of data. For bank connections, the artifacts required depend on connectivity options and security levels. For the customer to SAP Multi-Bank Connectivity portion, the use of Message Level Security is mandatory.

Please refer blog “SAP Multibank Connectivity Integration: BASIS Perspective” to know about the certificates and how it is shared with MBC.

Connection Options

Swift, API or SFTP, Host2Host or EBICS

The solution is fully SWIFT certified as SWIFT L2BA provider and offers the possibility to connect to the extensive list of SWIFT banks throughout the world.

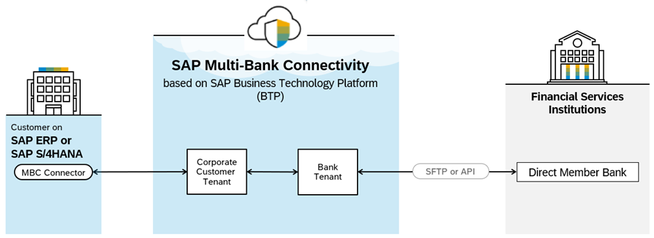

Direct Member Banks are connected via a standardized connection using bank APIs or protocols like SFTP.

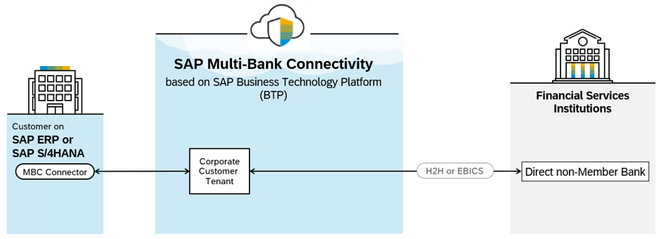

In an instance where a corporate customer is required to have a direct connection to a bank (Which is not a member bank) SAP MBC establishes a direct connection between the corporate customer and the non-member bank.

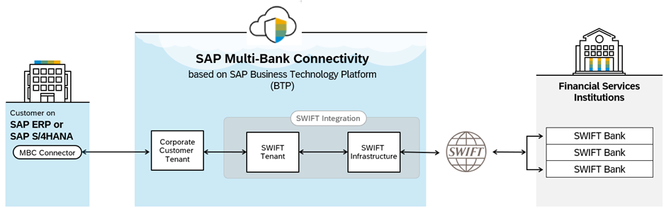

Swift Integration

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a member-owned cooperative that provides safe and secure financial transactions for its members.

SWIFT has established connections to thousands of banks. Many SAP customers want to connect to the SWIFT network from SAP. This is possible using SAP Multi-Bank Connectivity, without any additional software or hardware footprint on the customer's side. A third-party service provider (for example, typically a SWIFT service bureau) is no longer needed for SAP customers to send and receive messages over the SWIFT network.

SAP is a SWIFT Alliance Lite2 for Business Applications (L2BA) provider. In this model, SAP operates the SWIFT infrastructure and standardized integration for customers with a valid SWIFT agreement, using SAP as an L2BA provider in place.

An SAP customer wanting to connect to the SWIFT network from SAP must have membership to SWIFT, such as SWIFT Alliance Lite2. SAP is not a reseller of SWIFT so corporates must subscribe separately to SWIFT to get their BIC code and sign an agreement to cover messages passed via SWIFT. There is an option to ask for migration of their existing BIC however it is not recommended.

To establish the connection with SWIFT, SAP operates SWIFT software, SWIFT-specific hardware, and dedicated Internet connections to SWIFT. SAP Multi-Bank Connectivity and the connector for SAP Multi-Bank Connectivity use this setup for the connection between the corporate customer (SAP ERP system) and the banks.

Swift message types - SAP Multi-Bank Connectivity supports both FIN and FileAct-based communication. FIN enables the exchange of messages formatted with the traditional SWIFT MT standards. FileAct transfers any type of data, such as text, spreadsheet, XML formatted files, and images. It supports all types of character sets and any content structure – you can use SWIFT message formats MTs or MXs, domestic formats, or your own proprietary ones. Files of almost any format or size may be sent, up to hundreds of MB.

To proceed with an SAP Multi-Bank Connectivity integration via SWIFT, the SWIFT Customer Security Program (CSP) must be in place. This is a prerequisite to any entity that transmits data to or from the SWIFT Network.

Important Note – SAP also provides SAP Integration Package for SWIFT, with which you can establish one single communication channel for multibank communication. This solution gives you direct access to SWIFTNet and integrates SAP ERP Financials with the SWIFT infrastructure. It is recommended that you use SAP Multi-Bank Connectivity instead of the Integration Package for SWIFT. Please also note that this Integration Package for SWIFT is not supported with SAP CPI (Cloud Platform Integration).

Direct Bank Integration

SAP MBC can connect directly with the banks in following two ways:

Member Banks

Banks can opt to join SAP Multi-Bank Connectivity as a member. In this case, they subscribe to the network to provide an easier and less complicated integration for corporate customers utilizing SAP Multi-Bank Connectivity.

Non-member banks

If the bank is not a member bank, SAP MBC can still establish the connectivity with the below options:

Host-to-Host - A host-to-host connection sends messages from the corporate system to the corporate tenant and then to a bank back-end system. For integrating your tenant directly to your bank, SAP Multi-Bank Connectivity generally offers connectivity via Secure File Transfer Protocol (SFTP).

EBICS - An EBICS contract with the bank is the prerequisite to leverage this type of integration. The customer needs to request the EBICS partner ID and user IDs.

MBC Membership

MBC membership is based on a flat fee + transactions.

Flat Fee

Flat fee depends on the number of banks and swift connectivity. There is an option to go for base membership if the number of banks to be connected are upto 5 banks. Please note that member banks are not counted in calculating the 5 banks for this membership.

However, if a corporate needs to connect to more than 5 banks or if corporate needs to connect via SWIFT, they have to go for an advanced connection package in addition to base membership.

Transaction based

In addition to a flat fee, corporates also need to pay a fee based on the number of transactions (instructions, status, reports, and other messages).

Onboarding

Onboarding is the process of connecting a corporate to SAP Multi-Bank Connectivity. Onboarding covers tasks that are necessary to configure the data exchange and the connection between the corporation's system and SAP Multi-Bank Connectivity.

The onboarding to the solution is very straightforward and delivered through a private cloud owned and managed by SAP that is secure and partitioned by each customer and their network of banks.

SAP MBC Scoping team triggers an email to the corporate to establish the high-level scoping. Generally, the following questions are asked to start the process:

- Number of banks with bank details

- Connectivity type H2H, EBICS, MEMBER or SWIFT

- File formats

- Timeline for the implementation

- BIC numbers in case of existing SWIFT customer

- SAP System details

- Project team details

Once the details are submitted, the SAP MBC onboarding team will send the welcome pack which will contain detailed information about the onboarding process.

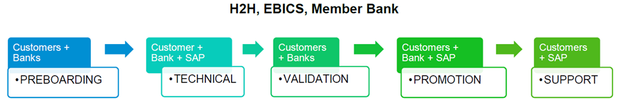

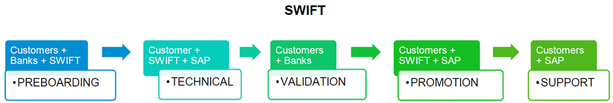

Below are the high-level steps:

The onboarding team also provides a checklist to be completed and returned.

Once the onboarding is completed, MBC tenants will be provisioned and S user ID will be added. SAP TIE (Technical Integration Engineer) will also be assigned to the project.

MBC configuration

Below are the basic configuration steps:

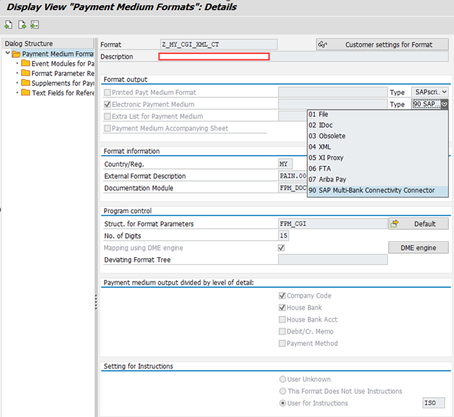

OBPM1:

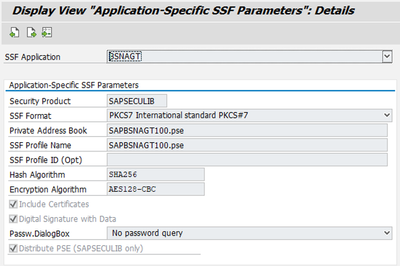

Multi-Bank Connectivity Connector → Maintain SSF Application Parameters

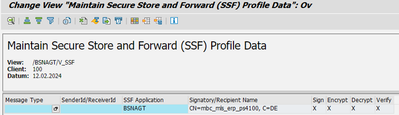

Multi-Bank Connectivity Connector → Maintain Secure Store and Forward (SSF) Profile Data

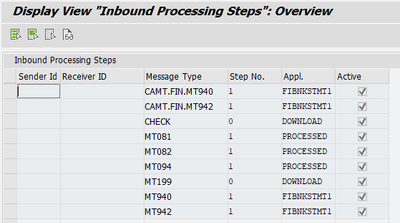

Multi-Bank Connectivity Connector → Maintain Inbound Processing Steps

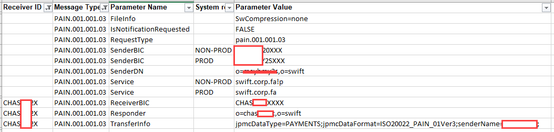

Multi-Bank Connectivity Connector → Maintain SWIFT Parameters

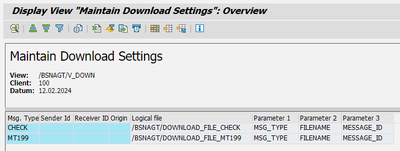

Multi-Bank Connectivity Connector → Maintain Download Settings

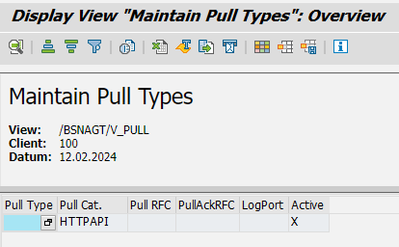

Multi-Bank Connectivity Connector → Maintain Pull Types

You can also perform some of the setting at MBC tenant side like mapping of message types, file naming convention etc.

MBC connector Monitor

T-Code /BSNAGT/MONITOR or Fiori app "Manage Bank Messages" (App ID F4385)

For the integration between the customer's SAP system and SAP Multi-Bank Connectivity, the connector for SAP Multi-Bank Connectivity is utilized. All messages to and from SAP Multi-Bank Connectivity pass through the connector.

MBC connector is integrated with the Payment monitor in BCM.

Reference Material

SAP MBC Product page

https://www.sap.com/india/products/financial-management/multi-bank-connectivity.html

MBC Help Portal

MBC Configuration Guide

MBC FAQs

SAP Note - 2915507 - SAP Multi-Bank Connectivity list of contacts

https://me.sap.com/notes/2915507

Blog: SAP Multibank Connectivity Integration: BASIS Perspective

原文地址:https://blog.csdn.net/dwjnhkbc123/article/details/142363384

免责声明:本站文章内容转载自网络资源,如本站内容侵犯了原著者的合法权益,可联系本站删除。更多内容请关注自学内容网(zxcms.com)!